Why Lithium?

MAX Power sees an incredible opportunity to take part in the growing demand for electric vehicles, mobile devices, and grid storage that is creating a long-term supply shortage and increasing lithium prices.

With the Biden Administration providing $3.16B USD in funding for lithium projects domestically, and investing $5B USD towards the EV charging network, the U.S. is all in on the electrification of America. [1] – and Canada has adopted a similar position.

It is estimated that with the immense increase in battery metals demand, the world will need almost 400 new mines by 2035.[2]

[1] Benchmark Mineral Intelligence

[2] www.energy.gov/articles/biden-administration-announces-316-billion-bipartisan-infrastructure-law-boost-domestic

Life Financing

MAX Power Investment Highlights:

-

Discovery-driven and capital markets savvy group focused on unique opportunities to create shareholder wealth in North America’s shift to decarbonization

-

New grassroots lithium discovery with robust upside potential in the heart of the American West

-

Technological prowess: MAX Power is in a cooperative research and development agreement with the University of California Lawrence Berkeley National Laboratory (LBNL) to develop state-of-the-art Direct Lithium Extraction technologies for brine resources

-

Canadian division features large strategic land packages in the James Bay and Nunavik lithium districts in Quebec

-

Favorable share structure: MAX Power has managed its share structure wisely – only 49.5 million shares outstanding, featuring a strong group of core investors

-

Proven management and geological team that knows how to drive shareholder value

-

First-ever diamond drilling has confirmed the discovery of near-surface lithium-rich clays over a broad area of state-leased ground

-

Notably, the high-grade hectorite-saponite mix of lithium in the clays within the sediments at Willcox is amenable to a straightforward separation process as demonstrated by the Lawrence Berkeley National Laboratory in California (“Berkeley Lab”) where samples in the clay fraction from the Discovery Zone also averaged 1,243 ppm lithium through initial testing using a particle size that can be reasonably expected to gravitationally separate in a full-scale commercial mining process

-

Each of the first three triangular-spaced drill holes in the northern section of MAX Power’s property, the Discovery Zone covering an area 1,640 feet x 1,640 feet x 2,300 feet, intersected lithium at shallow levels over significant widths, including 15.5 feet grading 775 ppm lithium within a broader whole rock interval of 184 feet averaging 571 ppm lithium in drill hole WP-23-02

-

This early-stage discovery remains open in all directions with MAX Power also exploring options to expand its land package

-

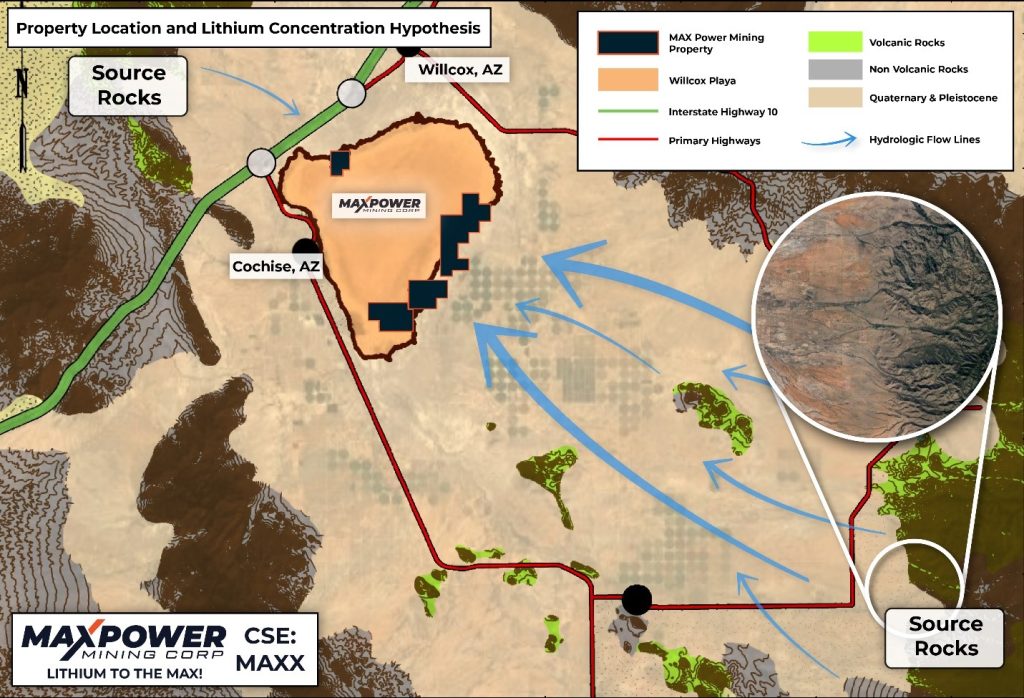

Based on a compilation of MAX Power’s work to date, and historical data, geologists believe the Discovery Zone represents just a fraction of the scale potential of Willcox with higher-grade mineralization expected in areas of increased clay content

-

The next drill holes at Willcox are planned for the southern portion of the Property where the largest and most intense low resistivity anomaly has been detected, overlain by a very low gravity anomaly (BLM drill permits have been received for this very promising area)

-

MAX Power’s land package covers a 6-mile-long northeast trending corridor (3,754 acres) along the eastern side of the broader 50 sq. mile Playa. Much of the rest of the Playa is leased by the U.S. Defense Department from the Bureau of Land Management (BLM)

-

The entire Playa, which up until MAX Power’s program had never been previously diamond drilled, is now believed to be prospective for a potentially very large lithium deposit surrounded by top tier infrastructure including roads, rail, power and services located immediately off Interstate 10 in southeast Arizona, leading to Tucson and Phoenix

James Bay Lithium District Highlights

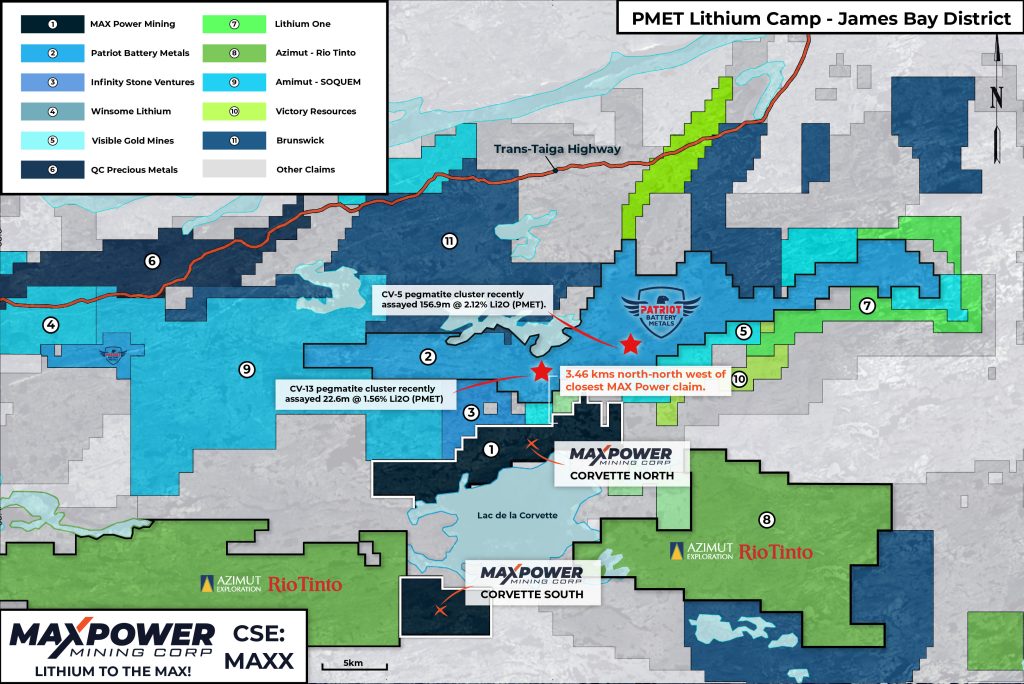

- MAX Power owns a 100% interest in two properties totaling nearly 100 sq. km (Corvette Lake North and Corvette Lake South) located adjacent to Patriot Battery Metals’ (PMET’s) Corvette Property discoveries.

- MAX Power’s Corvette Lake North and South properties cover 189 mineral claims spanning a total of 9,709 hectares in this world class lithium district in the James Bay region of Quebec.

- Rio Tinto, one of the largest mining companies in the world now searching for lithium, recently entered into agreements to acquire up to a 70% interest in two properties in close proximity to MAX Power in James Bay (contiguous to Corvette South and adjacent to Corvette North, see map below). The agreements contemplate an aggregate value of up to $115.7-million in expenditures and cash payments.

- MAX Power has identified multiple radiometric anomalies from preliminary first-ever airborne survey data covering approximately two-thirds of its Corvette Lake North Lithium Property to date. Multiple surface samples were also collected in late Q3 with assays pending.

- Excellent infrastructure and access – the Corvette Lithium Camp is located within 19 km from all-weather road access and 18 km from James Bay Hydro power lines.

- James Bay is strategically located in a favored jurisdiction (Quebec) to provide domestic supply of lithium to North America.

Nunavik Lithium District Highlights

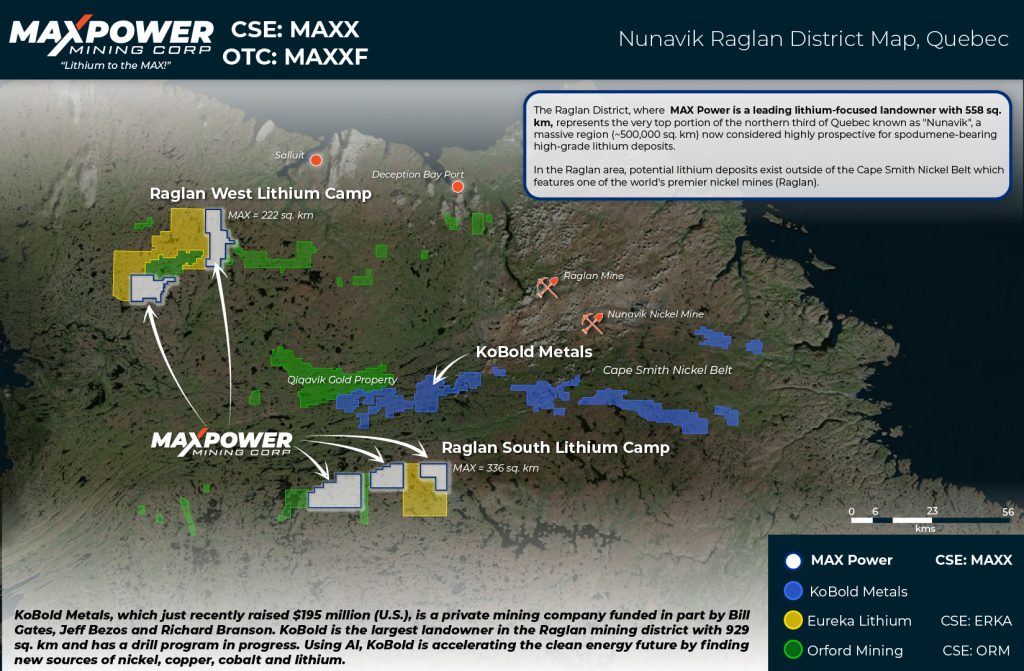

- MAX Power is a leader in the pursuit of new high-grade lithium deposits in a vastly under-explored part of Quebec known as Nunavik which occupies the top third of the province (~500,000 sq. km). This region, which currently hosts two operating nickel mines, is now considered highly prospective for spodumene bearing lithium pegmatite deposits based on an extensive review of historical and recent exploration data.

- MAX Power is the largest landowner in the Raglan South Lithium Camp (336 sq. km) where it has captured approximately 80% of the nearly 60-km-long northern portion of the district straddling a major tectonic boundary. MAX owns another 226 sq. km in the Raglan district at Raglan West, followed by a large position in the New Leaf Camp in southern Nunavik with the Spark Property (184 sq. km).

- Privately-owned KoBold Metals, which recently raised $195 million (U.S.) and is funded partly by Bill Gates, Jeff Bezos and Richard Branson, is actively drilling for a new battery metals discovery in Nunavik in the Cape Smith Nickel Belt. KoBold’s land package begins approximately 10 km north of MAX Power’s Raglan South Lithium Project.

- MAX Power’s Nunavik properties were carefully selected at the beginning of the Nunavik lithium staking rush in 2023 based on robust geochemistry (some of the best lithium and cesium values in lake bottom sediments in the entire Quebec government database), favorable geology and geophysics, and historically mapped pegmatites. Very little exploration has occurred in Nunavik outside of the Cape Smith Nickel Belt, one of the world’s premier nickel belts, which includes Quebec’s largest nickel mine (Raglan) operated by Glencore.

- MAX Power teamed up with GroundTruth Exploration to carry out an innovative 2023 Nunavik exploration program with results pending.

- MAX Power’s Spark Property, which features an approximate 3-km-long, 300-meter wide pegmatite structure that was never historically sampled for lithium (Assessment Report GM57402), is located 500 km directly north of Patriot Battery Metals’ Corvette deposit and MAX’s adjacent Corvette Lake North Property in the prolific James Bay district.

Supply

Global lithium mining market is expected to grow from $3.33B in 2020 to $6.37B in 2030. 98% of the world’s lithium production occurs in Australia, Latin America and China.[1]

Demand

Lithium demand is set to rise from 500,000 tonnes of lithium carbonate equivalent (LCE) in 2021 to an estimated 3,000,000 – 4,000,000 tonnes by 2030, representing , more than a 300% increase within the decade.[2]

Price

Lithium surged from $6,000 per tonne to over $78,032 a tonne in 2022, representing a 13-fold increase in less than two years.[3]

Worldwide EV sales are forecast to increase from 6.5M units to 51M by 2030. Almost 400 new mines are needed to meet this demand by 2035. With over 80% of lithium ion battery production being in China and currently only one operating lithium mine in the United States, the U.S. Department of Energy is making a $3.16B investment in lithium ion battery production domestically to secure the supply of the future.

Source:

[1] Benchmark Mineral Intelligence

[2] Benchmark Mineral Intelligence

Our Team

CHIEF EXECUTIVE OFFICER & DIRECTOR

Mr. Mlait has extensive experience in management of TSX, TSX Venture and Canadian Securities Exchange (CSE) companies as well as raising capital for public and private companies in the technology and mineral exploration sectors. He holds an MBA from Royal Roads University in British Columbia with his BA (Economics) from Simon Fraser University. Mr. Mlait has been CEO of Cannabix Technologies since 2014 and has also led several exploration companies targeting Cu-Ni-PGE, gold and uranium.

SENIOR GEOLOGIST & EXPLORATION MANAGER

Mr. Lauder is a senior level mine and exploration geologist whose extensive experience includes working for top tier mining and exploration companies across Canada and West Africa. Notably, he was actively involved in a supervisory position in Goldcorp’s exploration team that brought the Eleonore Project in Quebec through a positive feasibility study, construction and eventually full production. Quebec is a key jurisdiction for MAX Power as it advances a North American focused lithium strategy.

CHIEF FINANCIAL OFFICER, DIRECTOR, & CORPORATE SECRETARY

Mr. Loree has held senior accounting roles for public and private companies across multiple industries including renewable energy, exploration, and construction. During his career he has also performed capital raising activities for both private and public companies, primarily in the exploration and renewable energy sectors. Prior to entering the accounting field, Mr. Loree spent three years as an investor relations manager for several public companies and two years in the banking industry. Mr. Loree holds a Certified Management Accountant designation, a Financial Management Diploma from the British Columbia Institute of Technology, and a BA from Simon Fraser University.

DIRECTOR

Mr. Clarke is an entrepreneur and professionally registered geologist who obtained a Master of Science degree from the University of the Witwatersrand while studying as an international student in Johannesburg, South Africa. Mr. Clarke has worked on gold, platinum group metals, copper and energy projects. While a director of Bonterra Resources (TSX: BTR) he coordinated all exploration which led to the definition of the first NI-43-101 gold resource on the Gladiator deposit by Snowden. He has 17 years of experience as a successful geologist and has been a director of public companies continually since May 2010.

DIRECTOR

Mark Scott is the founding President & CEO and a director of CSE-listed Sassy Resources, and is also the President, CEO and a director Sassy subsidiary Gander Gold Corporation. Mark is a former Vice-President of Vale Canada Ltd. and Head of Vale’s Manitoba Nickel Operations, one of Canada’s largest fully integrated mining and metallurgical sites, where he managed an annual budget in excess of $500 million (U.S) and a workforce of about 1,875 He has over two decades of experience in all phases of surface and underground mining, metallurgical processing, exploration and service functions within multiple mining majors. Mark holds a Bachelor of Arts (BA) degree from Dalhousie University, a Master of Industrial Relations (MIR) degree from University of Toronto, and a Master’s Certificate in Project Management from Schulich School of Business (York University).

DIRECTOR

A lawyer at Fasken Martineau DuMoulin LLP’s Securities and Mining practice groups, Mr. deJong is well versed in the public markets and also serves as a director and corporate secretary for multiple private, public and not-for-profit companies. Mr. deJong advises in matters relating to financings, mergers/acquisitions, corporate governance, continuous disclosure, stock exchange listings and other matters.

Latest News

Check out our latest news & media posts

We’re entering an exciting time with MAX Power and we want to ensure you’re kept up to speed with everything that’s going on. Whether you have a question, would like more information or simply want to be added to our email list to receive all of the latest updates on MAX Power, be sure to sign up to keep in the know!

Investor Relations

Adrian Sydenham

info@marketsmart.ca

Toll-free:1-877-261-4466