VANCOUVER, Canada (April 21, 2023) – MAX Power Mining Corp. (CSE: MAXX, OTC: MAXXF) (“MAX Power” or the “Company”) is pleased to announce it has acquired the 184 sq. km Spark Property in the heart of the emerging New Leaf Lithium Camp in Northern Quebec’s under-explored Nunavik region, 500 km directly north of its Corvette Lake North Property in the James Bay district. Nunavik, which hosts two operating nickel mines, is a vast area (~450,000 sq. km) comprising approximately the top third of Quebec. Nunavik has been the focus of an initial staking rush for lithium based on rigorous reviews of historic and recent data. The data strongly support the potential for this region to host spodumene-bearing lithium pegmatite deposits. Nunavik is above the timberline and outcrop is abundant. This will aid creative and cost- efficient exploration methods for this region that MAX will be deploying as it proceeds quickly to the drill stage.

Highlights:

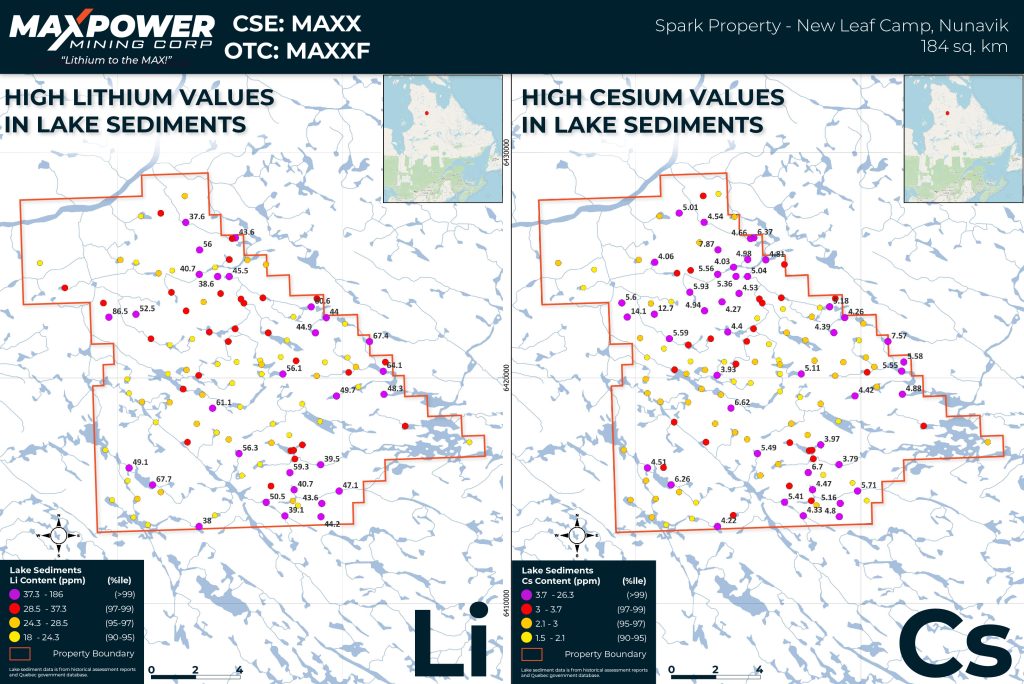

• Highly favorable geochemistry: The Spark Property contains a high concentration of 99th percentile lithium and cesium in lake sediments, including up to 86.5 ppm lithium, based on historical assessmentreports and Quebec government data (see Figure 1);

• Large pegmatite structure: Historic work by SOQUEM, while searching for uranium in the late 1990’s (Assessment Report GM57402), documented a prospective structure dominated by pegmatite dykes that is approximately 3 km long by 300 meters wide. There was no reported sampling of those dykes;

• Geology: The Spark Property features a range of geology including mafic gneiss units with basaltic amphibolites. The geology is considered prospective for hosting lithium;

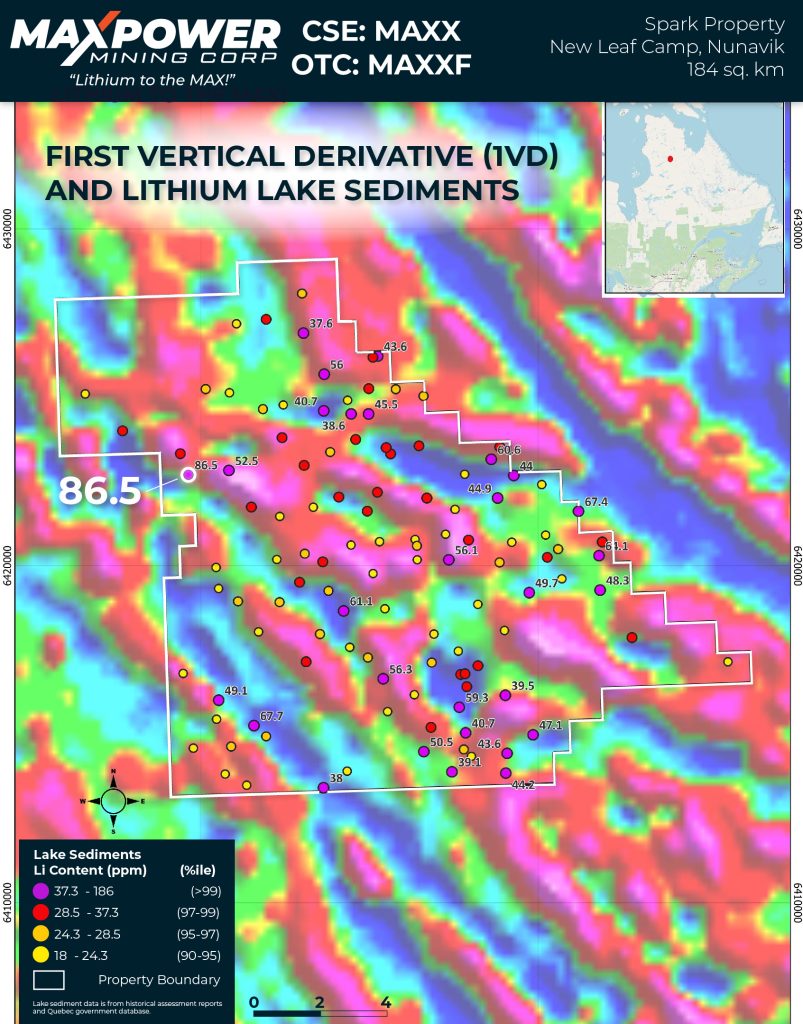

• Geophysics: A study of magnetic surveys covering the Spark Property shows a favorable structural environment for the emplacement of pegmatites (see Figure 2);

• Exploration plan: MAX will be partnering with GroundTruth Exploration to conduct an efficient first-pass sweep of the Spark Property with a quick follow-up of encouraging target areas. Crews will be highly trained for working in Nunavik, using state-of-the-art technology. The most prospective lithium targets will then be drill tested during the 2023 season;

• Another Spark? MAX continues to review all of Nunavik for the potential acquisition of other properties with the potential to host spodumene bearing pegmatites. Mr. Peter Lauder, Senior Geologist and Exploration Manager for MAX Power, commented: “This is thinking big and outside the box, an exciting move for MAX and consistent with management’s strategy of building a North American-focused lithium company that can differentiate itself in a lithium space that has grown substantially in the past year. This is why I took this position with MAX after working much of my career in Quebec for various senior and junior miners. If I had to describe the geological potential of Nunavik in one word, it is ‘remarkable’.”

Mr. Rav Mlait, MAX Power CEO, commented: “MAX has just started its second year as a CSE-listed company and we are now rolling out the game plan we envisioned to become an innovative and dynamic leader in the North American lithium sector. We have a strong cash position in excess of $3 million, an attractive share structure, and the right team in place to create sustained shareholder value.” Mr. Mlait concluded, “We expect to enter a period of strong news flow given developments in Nunavik and James Bay, and we continue to examine other potential lithium opportunities in North America.”

Location

The Spark Property is located in the southern half of Nunavik, 175 km southwest of the community of Tasiujaq and 500 km directly north of MAX’s Corvette Lake North Property in the James Bay District of Quebec. The northernmost claim at Corvette Lake North is just 3.5 km south of Patriot Battery Metals’ CV-13 discovery.

Figure 1 – Lithium & Cesium in Lake Sediments at Spark Property

Historical Work at Spark

The most relevant historical work at Spark was completed by SOQUEM in 1998 (report GM57402). At the time, SOQUEM was exploring for uranium on its Vernot Project. The assessment report for this historical work described a large structure dominated by pegmatite. This structure arcs gently from the north towards the south before being truncated by a fault striking at 060°. The mapped pegmatite was intruded into the surrounding paragneiss. As this work was completed before the implementation of NI 43-101, it was not supervised by a Qualified Person and must be treated as historical information.

Figure 2 – First Vertical Derivative (1VD) and Lithium Lake Sediments at Spark Property

Acquisition Terms

The Company entered into a purchase and sale agreement (“Agreement”) for 100% the Property with consortium of six sellers made up of Shawn Ryan et al. (the “Vendor”) for consideration of 1.5 million common shares (the “Consideration Shares”) of the Company and $121,600 cash. Furthermore, the Company has granted a 1% net smelter royalty (NSR) to Shawn Ryan in relation to the Property. All common shares issued in connection with the Agreement are subject to a four-month hold period under applicable Canadian securities laws. All terms are subject to the approval of the Canadian Securities Exchange (“CSE”).

Bonus shares are payable to the Vendor with respect to the Agreement as follows:

• 1,000,000 share one-time bonus payment if a drill hole in 2023 drill program at Spark intersects a core length

of at least 100 meters grading at least 2.0% Li2O;

• 500,000 share one-time bonus payment if a drill hole in 2023 drill program at Spark, separate from the above

100-meter core length, intersects a core length of at least 50 meters grading at least 1.5% Li2O.

Marketing Agreement

MAX Power also announces that it has engaged Phenom Ventures LLC (“Phenom”) (Address: 3250 NE 1st Avenue Ste 305, Miami, FL 33137, primary contact Eric Muschinski, email: info@phenom.ventures) to execute a digital media marketing campaign for the Company to heighten market awareness and broaden the Company’s reach in North America. In consideration for the services and pursuant to the invoice agreement with Phenom, the company will pay a fee of $200,000 USD for a term of six months which begins April 24, 2023. Phenom does not have any prior relationship with the Company. Consideration offered to Phenom does not include any securities of

the Company. All terms are subject to the approval of the CSE.

Stock Option Grant

The Company announces the granting of 2,000,000 stock options to directors, officers and management. The stock options, subject to CSE approval, will have an exercise price of $0.65 and will expire after 5 years. Half of the stock options will vest on the date of grant and the remaining 50% will vest 12 months from the date of grant.

Qualified Person

The technical information in this news release has been reviewed and approved by Peter Lauder, P.Geo., Member of the Order of Geologists of Quebec and Senior Geologist and Exploration Manager for MAX Power Mining Corp. Mr. Lauder is the Qualified Person responsible for the scientific and technical information contained herein under National Instrument 43-101 standards.

About MAX Power

MAX Power is a dynamic exploration stage resource company targeting domestic lithium resources to advance North America’s renewable energy prospects.

Contact:

info@maxpowermining.com

MarketSmart Communications

Phone: 1-877-261-4466

Forward-Looking Cautionary Statement

This press release contains certain “forward-looking statements” within the meaning of Canadian securities

legislation, relating to exploration, drilling, mineralization and historical results on the Properties; the

interpretation of drilling and assay results, the initiation of and the results thereby of any future drilling program,

mineralization and the discovery mineralization (if any); plans for future exploration and drilling and the timing

of same; the merits of the Property and the Nunavik region, generally; the potential for lithium within the

Properties; commentary as it related to the opportune timing to explore lithium exploration and any anticipated

increasing demand for lithium; future press releases by the Company; funding of any future drilling program;

regulatory approval, including but not limited to the CSE. Although the Company believes that such statements are

reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements

are statements that are not historical facts; they are generally, but not always, identified by the words “expects,”

“plans,” “anticipates,” “believes,” “interpreted,” “intends,” “estimates,” “projects,” “aims,” “suggests,” “often,”

“target,” “future,” “likely,” “pending,” “potential,” “goal,” “objective,” “prospective,” “possibly,”

“preliminary”, and similar expressions, or that events or conditions “will,” “would,” “may,” “can,” “could” or

“should” occur, or are those statements, which, by their nature, refer to future events. The Company cautions that

forward-looking statements are based on the beliefs, estimates and opinions of the Company’s management on the

date the statements are made, and they involve a number of risks and uncertainties. Consequently, there can be no

assurances that such statements will prove to be accurate and actual results and future events could differ

materially from those anticipated in such statements. Except to the extent required by applicable securities laws

and the policies of the CSE, the Company undertakes no obligation to update these forward-looking statements if

management’s beliefs, estimates or opinions, or other factors, should change. Factors that could cause future

results to differ materially from those anticipated in these forward-looking statements include risks associated with

possible accidents and other risks associated with mineral exploration operations, the risk that the Company will

encounter unanticipated geological factors, risks associated with the interpretation of assay results and the drilling

program, the possibility that the Company may not be able to secure permitting and other governmental clearances

necessary to carry out the Company’s exploration plans, the risk that the Company will not be able to raise sufficient

funds to carry out its business plans, and the risk of political uncertainties and regulatory or legal changes that

might interfere with the Company’s business and prospects. The reader is urged to refer to the Company’s

Management’s Discussion and Analysis, publicly available through the Canadian Securities Administrators’

System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com for a more complete

discussion of such risk factors and their potential effects.

The Canadian Securities Exchange (CSE) has not reviewed, approved, or disapproved the contents of this news release.